Microfinance institutions (MFIs) continue to play very important roles as financial intermediaries for most of the world’s poor. In Sierra Leone, Liberia and the Gambia, as many as 38 MFIs are licensed by the central banks and together serve about 250,000 clients.

Almost 100% of the time, these MFIs are paper-based and have been unable to leverage technology to manage their operations more efficiently and gain from the fast-paced digital ecosystem’s growth to scale and deliver better services to their clients. In instances where they employ Information Systems, these are often expensive to procure and run and have high learning curves. At the end, the poor suffer.

So what can be done to better the situation?

The following is a short Q&A session through which Salton Massally, CTO of iDT Labs, talks about iDT Labs’ microfinance work in Uganda and how it enables us to bring better solutions to West African MFIs and rural financial organizations such as credit unions and community banks:

Question: Given iDT Labs’ focus in West Africa, how did you come to work with a financial institution in Uganda?

Answer: Our lead of Microfinance Technology Services has extensive experience with the Ugandan Microfinance market and is coincidentally also from Uganda. He had worked with the team previously and was pivotal in the initial introductions phase.

Our Microfinance Technology Services, which form a section of our Financial Technology (Fintech) Unit, are designed to help small and medium sized MFIs efficiently and cost-effectively integrate technology into their business processes.

Apart from wanting to subscribe to EZ Bank, an Apache Fineract backed cloud based core banking service for MFIs, they were looking at integrating customer deposit accounts with the Interswitch ATM network, enabling easy withdrawals from any Interswitch branded ATM in the country.

I was fascinated by the scope of the project and the ambition of the Advance team to become a debit card issuing entity, a service delivery medium generally dominated by traditional financial institutions. On top of that this collaboration provided our young team an opportunity to gain insightful experiences working in a more developed DFS ecosystem and learn lessons that can be applied to the fragile state context we usually operate in.

Question: Can you tell us about iDT Lab’s Digital Microfinance Services?

Answer: We aim to bridge the financial inclusion divide one mobile phone at a time.

The advent of branchless, mobile-first, digital banking models leverages the convergence of trends spurred by the ubiquity of mobile phones worldwide, including the exponential adoption of smartphones in urban areas, the explosion of mobile data, and the latest advances in computing technology.

We see these trends more so in fragile countries like the ones where we work, but there is limited donor attention and limited global/regional private sector attention. At iDT Labs, we are pushing against the status-quo that has become a norm in fragile states. We are working locally with last-mile institutions like the MFIs and credit unions to adopt context-specific transformative technology and deliver an affordable and diverse range of financial services to the unbanked.

To help these institutions, several key infrastructural challenges have to be overcome for which we are currently focusing on sustainably developing Core Banking as a Service, Digital Payments as a Service, Credit Look-up as a Service, and Digital Identification as a Service.

Question: What are some of the opportunities you see for the Microfinance Sector in iDT Labs’ immediate markets — Sierra Leone, Liberia and the Gambia?

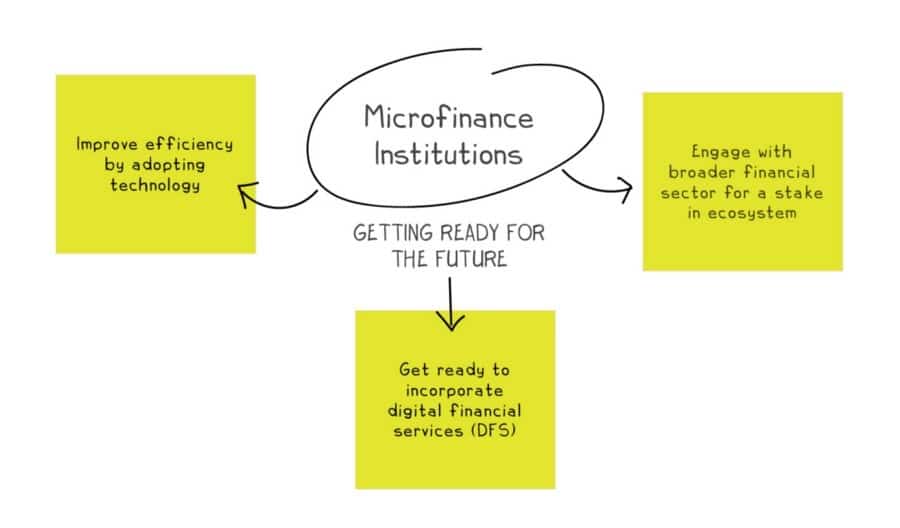

Answer: There is a global debate happening about the need for microfinance institutions to adapt to the rapidly changing landscape of digital financial inclusion or risk becoming irrelevant. In these fragile markets, the cost of digital financial services (DFS) is often times higher than cash-based transactions. This shows that a lot more needs to be done to develop the broader DFS ecosystem of interoperability, agent-sharing among others.

These MFIs need to a) improve their operational efficiency by adopting technology, b) engage with the broader financial sector to push for a stake in the wider ecosystem development initiatives, and c) get DFS-ready.

Overall, there are significant gains to be realized by going paperless and becoming data-driven to offer the most flexible and customer-oriented financial services in these markets. This will help further the goal and business case of going cashless as well, especially in Sierra Leone and Liberia who are signatories to the Better Than Cash Alliance, where the respective governments are prioritizing the development of inclusive payment systems and digitizing bulk payments such as government salaries, social protection cash transfers and so on to expand DFS nationally.

Question: How does this project forward iDT Labs’ broader Financial Inclusion Work?

For starters it allows us to experiment with EzBank in an East African DFS setting and increase the diversity of financial institutions we work with.

Mostly importantly, West Africa is seeing a rise in both deposit taking MFIs and digitization of service delivery to customers. These MFIs realize that customers are better connected than ever, want to transact from the comfort of their living rooms, have information and services on-demand at their fingertips; the bottom of the pyramid, where most MFI clients are, is not exempt from these winds of change.

Consequently, MFIs are looking to better integrate with the mobile payment ecosystem and even visionary ones like Advance Uganda are looking beyond that at integrating with traditional DFS mediums like ATMs and POS, mediums associated solely with traditional financial institutions.

However, integrating with processors and ATM and POS acquiring networks is complicated and cumbersome both from a technological perspective and that of maintaining back-end processes like settlements and dispute resolution. The ISO8583 protocol commonly used to exchange messages is complicated, the systems running these platforms have a high requirement of service availability, security and a scale too expensive for the MFIs to operate at.

ISO8583.io, a service being piloted by iDT labs, was conceptualized in response to the increased demand we see coming from deposit taking MFIs to join traditional POS & ATM networks but lack of capacity to efficiently do so. Simply put, it is a platform that aggregates issuers, MFIs in this case, wanting to issue cards to their customers, connecting them with global stream of acquiring and processing entities like Interswitch, Mastercard, and VISA. Advance Uganda presented an excellent opportunity to pilot this platform with a progressive and patient team.

Question: What are the unique challenges of digitizing microfinance in the West African fragile states? Can you compare this to your experience in Uganda?

The poor computing capacity of these institutions presents the biggest challenge we face in the region. Encompassing both network connectivity, especially beyond headquarter and in more rural branches, and end-user inexperience with working with computer system.

Poor internet connectivity is accentuated by the browser-based cloud-hosted nature of EzBank presenting a serious risk to the adoption of our solution. Understanding that this is one of the harsh realities of the environments we operate in, we factored this limiting variable into the development of the user-interface, and so the system is usable in poor internet connections, however a break in connectivity or serious degradation of connectivity renders the system unusable.

Mostly importantly, West Africa is seeing a rise in both deposit taking MFIs and digitization of service delivery to customers. These MFIs realize that customers are better connected than ever, want to transact from the comfort of their living rooms, have information and services on-demand at their fingertips; the bottom of the pyramid, where most MFI clients are, is not exempt from these winds of change.

Insufficient computing capacity of end-user also means tremendous effort has to be put into both training end-user and post-implementation support and we find that training usually exceeds the scope of just end-user application training and extends to basic and intermediate computer literacy courses.

Poor data Integrity of legacy systems, whether an existing application that was either poorly designed or poor data management techniques on the side of the user, or excel based data management strategy, means a lot of work has to be put into planning for and executing data conversion and in most projects historical data is in such a poor state that we have had to limit conversion to only active records.

As MFIs across the region are looking at digitizing not just their data and back-end processes but also service delivery, demand for value-added services like SMS-based transaction notifications and mobile money disbursement and repayments have been on the increase.

To incorporate this, given the nascency of the DFS ecosystem, we have had to spend considerable resources building infrastructural pieces, e.g. digital identification platforms, mobile payment gateway and SMS aggregators that these services depend on, rather than integrating with pre-existing platforms which is the case with more advanced ecosystems like those in East Africa. We have also had to do a lot of policy advocacy and ecosystem engagement and development.